Get free initial advice 24/7.

Call our free Employer Helpline now.

As featured in

You're in good hands

We give you control of your business. We provide contracts and policies that are customised to your needs. We offer help calculating complicated wages. We can advise you on dealing with difficult employees. Our experts will give you fast and accurate advice.

We're here to help. You need an answer now — whether it's for peace of mind or to deal with a crisis. 24 hours a day, 365 days a year, we're a phone call or email away.

We charge by the month — not by the minute. Affordable monthly subscription covers unlimited advice and document help, with no hidden fees. Request a quote now.

Employsure Protect, a financial product exclusive to Employsure clients, provides financial protection if you face an employment relations or health and safety claim. For full terms and conditions, please refer to the Product Disclosure Statement.

Call our helpline now to access free initial advice.

We've helped thousands of Australian businesses, just like yours.

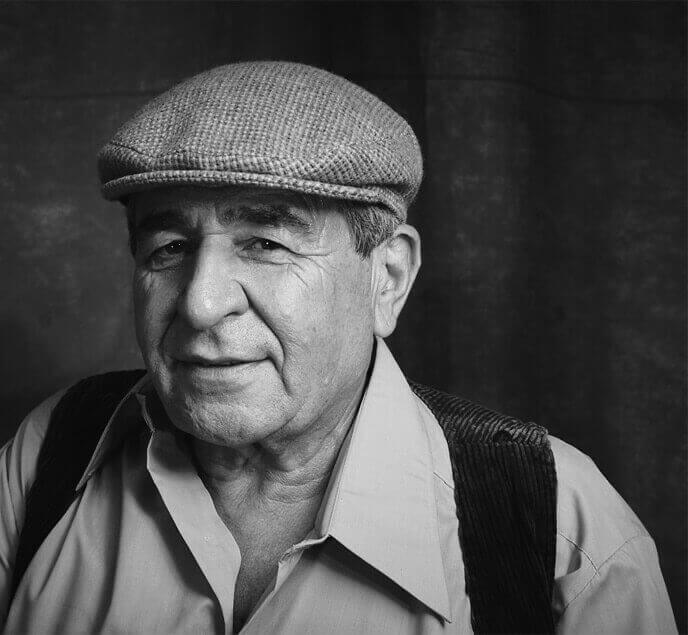

Employsure give us confidence in employing and retaining or dismissing staff and having a safe workplace. I effectively call them our external HR department. Even right down to having confidence with regards to workplace incidents and dispute handling. They've been just wonderful to us, it helps us sleep better at night.

Wayne Wilson, North Star Industries, Victoria

Employsure Client

We've helped thousands of Australian businesses, just like yours.

Have a question that hasn't been answered? Fill in the form below and one of our experts will contact you back.

Employsure helps Australian small business owners run safe, fair and compliant workplaces. We do this by giving employers like you the advice, support and documentation you need to comply with Australia's Fair Work Act 2009.

Sound complex? It is, which is why we're here. It might be better to think of us as your partner in employee management and workplace safety.

Our services take the complexity out of workplace laws to help small business employers protect their business and their people.

If you're an employer, then we're here to help you.

That depends on the package you purchase. We can offer Employee Management support, Workplace Safety support, or a combination of both.

These packages can include:

Additional packages that can be purchased through Employsure Face2Face may include in-house training, face-to-face support for employee management issues (such as disciplinary or redundancy meetings) or additional health and safety visits.

We'd like to think that the main benefit of using Employsure is confidence. Confidence that you are meeting your obligations as an employer, that you are running a safe workplace and that you are building a great business.

Just some of the practical benefits of being an Employsure client can include:

The best place to start is our Reviews Page where you can check out the positive reviews from our happy clients. You can also find us on TrustPilot, Feefo and Google Reviews.

Give us a call or drop us a line! You can call us on 1300 207 182, or send an enquiry via our Contact page and a member of our team will be in touch.

While we may occasionally be called Employee Sure, Employersure we are Employsure, dedicated to helping businesses owners with their HR needs.

Not a client yet?

1300 207 182Existing clients call (AU)

1300 651 415Existing clients call (overseas)

+61 2 8123 3640Employsure HQ

Level 6/180 Thomas St, Sydney NSW 2000About

Copyright © 2024 Employsure Pty Ltd. ABN 40 145 676 026

Employsure Protect is a financial product issued by Employsure Mutual Limited ACN 630 256 478 (AFSL 544232). Employsure Mutual has appointed Employsure Pty Ltd as its Authorised Representative (No. 001274577) to distribute the product and provide general advice. To decide if this product is right for you, please read the Employsure Protect Product Disclosure Statement (PDS) and Target Market Determination.