What is casual loading?

Casual loading is additional payment made on top of a casual employee’s fixed hourly wage. Usually, casual loading is 25%, however an Award or Enterprise Agreement (EA) may have a different amount.

Casual employees receive a higher rate of pay to compensate for the fact that they do not receive all the same paid entitlements as a permanent employee, such as annual leave or personal leave.

Note:

The Fair Work Act was amended from 27 March 2021 to include a definition of casual employment. Casuals do not have a firm commitment in advance about how long they will be employed for, or the days or hours they will work. An employee is casual if they are offered and accept employment that does not include a firm advance commitment that the work will continue indefinitely, and that is not based on an agreed pattern of ongoing work.

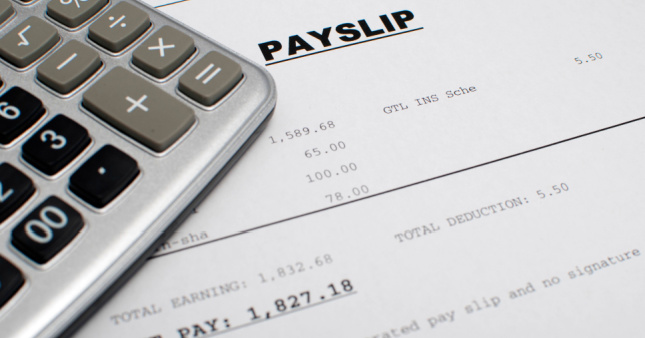

How to a calculate casual loading rate

To calculate the casual loading rate, you must multiply the hourly rate of a permanent employee by the percentage of the casual loading rate, as stated in the relevant modern award or enterprise agreement.

For example, if a casual worker is paid the current national minimum wage of $23.23 per hour, and their Award or Enterprise Agreement stipulates a casual loading rate of 25%, the calculation would be as follows:

$23.23 (permanent hourly wage) + $5.81 (25% of the permanent hourly wage)

= $29.04 (total hourly wage)

Get Workplace Advice Now

Call Our Team of Advisers Who Will Help You with Your Workplace Questions.

Casual employment obligations

As an employer, it is important to be fully aware of your workers’ casual employment rights, including the potential impact of a minimum wage increase. While paying your casual workers the correct wage is vital, you should also be aware of other aspects of your casual employment contract.

Below are a few of the areas that employers should be aware of in relation to casual employment rights:

Hours of work

Casual workers are not guaranteed a set number of hours per work, and they may be required to work irregular hours. This means you can ask a casual worker to work with a shorter notice period, within reason.

On the other hand, casual employees are not obligated to agree to the work each time. However, if they do agree to come into work, you may have to pay them for a minimum number of hours even if they have worked less. This is called a minimum engagement period and is stipulated in the Award or Enterprise Agreement.

Additional pay for hours worked

Like full-time and part-time employees, casuals are also entitled to receive additional payment when they work on public holidays, weekends, and additional hours. Depending on when a casual employee works, they could receive penalty rates or overtime rates.

Payment of overtime and penalties for casuals will vary based on the Award or Agreement. For example, some employees may be entitled to be paid a total of 250% of their hourly rate including casual loading if they work on a public holiday. This amount may be more or less for those covered by a different Award or Enterprise Agreement.

Although rates tables have been added to most awards to help you find the right pay it is still complex. We can help you with calculating overtime pay for your casual employees.

Personal Leave and Annual Leave

Casual employees are not entitled to paid leave, like personal or annual leave, including annual leave loading. However, they are entitled to a range of unpaid forms of leave, such as unpaid carer’s leave and unpaid compassionate leave.

Some casual workers may be entitled to long service leave depending on your state or territory laws.

Termination notice

In most cases, you do not have to give a minimum amount of notice when you terminate a casual employee. Similarly, in most cases, a casual employee does not have to give notice when they resign. There are, however, exceptions in some Awards, Enterprise Agreements, and casual Employment Contracts.

Casual conversion

Casual Conversion is another entitlement that some casuals have that now forms part of the National Employment Standards (NES). In short, if certain conditions are met, an employer has to either offer a casual employee the opportunity to go permanent, or the casual employee has the right to request that their employment type be converted to full-time or part-time. The specific rights depend on the size of the business and will also be impacted by whether or not the relevant employee is covered by an award.

Frequently Asked Questions

Are casual employees paid overtime?

Casuals will still receive overtime rates when prescribed by the award or enterprise agreement. The way this is paid will also depend on the award or enterprise agreement.

Do employers have to pay casual loading?

If an employer is employing a casual employee, then they do have to pay casual loading.

What is the minimum wage for casual employees in Australia?

The casual loading amount is determined by the relevant Award or registered Agreement covering that specific job. For award-free or agreement-free employees, the rate of casual loading derives from the National Minimum Wage Order.

Currently, the casual loading is 25% so the Minimum Wage for an award-free or agreement-free Adult Casual Employee is the minimum permanent rate of pay plus 25%.

Do you pay super on casual loading?

Generally, all employees are eligible for super. It doesn’t matter if the employee is full-time, part-time, or casual, however, there is an eligibility criterion that must be met.

How much Is casual loading in NSW?

For employers under the national workplaces system (mainly employers in the private sector), casual loading is, broadly, 25% of the fixed hourly wage. However, depending on the applicable award, enterprise agreement or employment contract, this casual loading rate may change.

How much notice do you need to give a casual employee?

Under the Fair Work Act, there is no notice requirement for casual employees. Unless an industrial instrument or modern award says otherwise, your business can simply stop offering shifts if you wish to terminate a casual employee’s employment.

How many hours can a casual employee work?

The maximum number of hours you’re allowed to work per week as a casual employee is 38 hours.

Please note that we cannot guarantee or accept any liability for the accuracy, reliability, currency, or completeness of the information available in this guide. When considering the information available about awards or pay rates, you should contact employment relations experts. Alternatively, you may wish to get independent advice from a legal professional based on your circumstances.